Horas! What are the ethical considerations regarding the origin of natural versus lab-created diamond rings? This question, like a finely cut diamond, reflects many facets. We shall delve into the heart of the matter, exploring the origins of these precious stones, from the depths of the earth to the gleaming laboratories where they are born. This exploration will encompass the journey of these sparkling beauties, from their humble beginnings to their final, dazzling forms.

We shall consider the processes of verification and the impact of these choices on consumer trust. We will then traverse the ethical minefield of environmental impact, examining the ecological consequences of both natural diamond mining and lab-created alternatives. Finally, we will consider the social and labor issues, including fair wages and the ever-present shadow of conflict diamonds, ensuring that we examine the impact on the communities touched by the industry.

Origin and Authenticity

Source: frontiersin.org

So, the real tea is, what’s the deal with ethics when it comes to diamonds? Natural vs. lab-grown, right? It’s a whole vibe! Before you cop that ring, you gotta think about the backstory. But hey, if you’re stuck, check out deets on Selecting the Best Diamond Ring Based on Specific Event and Recipient Preferences , ’cause knowing the receiver’s style is key.

Ultimately, it’s all about making a conscious choice and the ethics behind where your bling comes from.

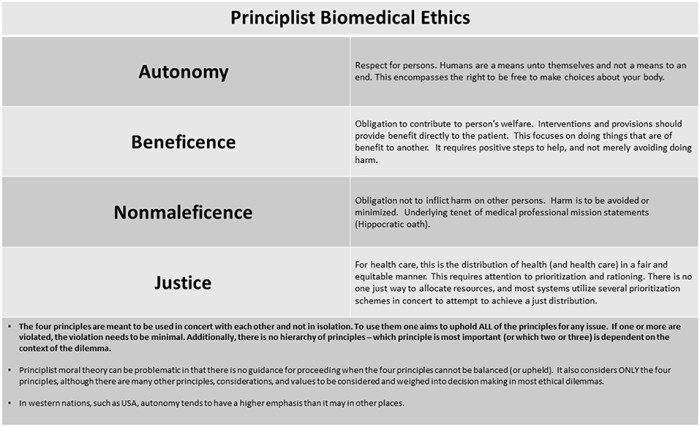

The ethical considerations surrounding diamond rings often hinge on the origin and authenticity of the diamonds themselves. Understanding where a diamond comes from and how its authenticity is verified is crucial for consumers making informed purchasing decisions and for upholding ethical practices within the industry. This section delves into the processes of tracing natural diamonds, authenticating both natural and lab-created stones, and the implications of these processes on consumer trust.

So, the real tea is, should we be vibing with natural or lab-grown diamonds? It’s a whole vibe about where they come from. But, diamond rings, bruh, they’re basically the ultimate flex for forever love, right? Check out why diamond rings consistently represent the ultimate symbol of enduring love and commitment , if you wanna know more. Back to the ethical drama though, what’s the real story behind the bling, and is it a good look for the planet?

Verifying Diamond Sources

Tracing a natural diamond’s origin involves a complex process designed to ensure transparency and ethical sourcing. This process helps to combat the issues associated with conflict diamonds and promote responsible mining practices.The process of tracing a natural diamond’s origin typically involves the following steps:

- Mine-to-Market Tracking: Many diamond mining companies employ rigorous tracking systems, following a diamond from the mine where it was extracted to the polishing and distribution stages. This often includes detailed record-keeping of the diamond’s journey, including location data, timestamps, and documentation at each stage.

- Certifications and Grading Reports: Reputable gemological laboratories, such as the Gemological Institute of America (GIA), provide grading reports that include information about a diamond’s 4Cs (Cut, Clarity, Color, and Carat weight), as well as its origin if the diamond has been submitted with the necessary documentation. These reports often include a unique identification number that can be used to verify the diamond’s details.

- Geological Analysis: Scientists use advanced techniques, such as spectroscopic analysis and trace element analysis, to determine a diamond’s geological origin. These methods analyze the unique characteristics of a diamond, such as the types of inclusions present and the ratio of specific elements, which can provide clues about the specific mine or region where the diamond was formed.

- Blockchain Technology: Some companies are utilizing blockchain technology to create a secure and transparent record of a diamond’s journey from mine to market. This technology creates an immutable ledger that tracks a diamond’s location and ownership, providing consumers with greater confidence in its origin and authenticity.

Authenticating Natural vs. Lab-Created Diamonds

The methods used to authenticate natural diamonds versus lab-created diamonds differ significantly, each with its own vulnerabilities. As lab-created diamonds become increasingly sophisticated, the challenges of accurate identification become more complex.

- Natural Diamond Authentication: Natural diamonds are authenticated using a combination of techniques:

- Gemological Reports: Third-party gemological laboratories issue reports detailing the diamond’s characteristics.

- Microscopic Examination: Gemologists examine the diamond under magnification to identify unique inclusions and characteristics.

- Spectroscopic Analysis: Techniques like infrared and ultraviolet spectroscopy analyze the diamond’s light absorption properties.

- Lab-Created Diamond Authentication: Lab-created diamonds are identified using methods that differentiate them from natural diamonds:

- Advanced Spectroscopy: Analyzing light absorption patterns to detect traces of the manufacturing process.

- Specialized Equipment: Using equipment designed to detect specific growth patterns and other indicators unique to lab-created diamonds.

- Laser Inscription: Many lab-created diamonds are laser-inscribed with identification marks for easy verification.

- Vulnerabilities:

- Misrepresentation: Some unscrupulous sellers may misrepresent lab-created diamonds as natural diamonds.

- Technological Advancements: As lab-created diamond technology improves, the line between natural and lab-created diamonds can blur, making authentication more challenging.

Impact on Consumer Trust and Purchasing Decisions

Diamond origin verification significantly impacts consumer trust and purchasing decisions. Consumers are increasingly concerned about the ethical implications of their purchases, including the origin of the diamonds they buy.

- Building Trust: Transparent origin verification builds trust by providing consumers with the information they need to make informed decisions.

- Influencing Purchasing Decisions: Consumers are more likely to purchase diamonds from companies that can demonstrate ethical sourcing and provide detailed origin information.

- Brand Reputation: Companies that prioritize ethical sourcing and transparency enhance their brand reputation. Conversely, companies that fail to provide this information may face negative publicity and a loss of consumer trust.

- Price Considerations: The price of a diamond can be influenced by its origin. Diamonds from conflict-free sources may command a premium.

Certifications and Standards Comparison

Different certifications and standards exist for natural and lab-created diamonds, providing varying levels of assurance regarding origin, quality, and ethical sourcing. The following table provides a comparison of these certifications:

| Certification/Standard | Type of Diamond | Focus | Key Features |

|---|---|---|---|

| GIA (Gemological Institute of America) | Natural & Lab-Created | Diamond Grading & Identification |

|

| IGI (International Gemological Institute) | Natural & Lab-Created | Diamond Grading & Identification |

|

| Kimberley Process Certification Scheme (KPCS) | Natural | Conflict-Free Diamonds |

|

| SCS Global Services | Lab-Created | Sustainability and Origin |

|

Challenges in Preventing Mixing of Diamonds

Preventing the mixing of natural and lab-created diamonds in the supply chain presents several significant challenges. These challenges require constant vigilance and the implementation of robust tracking and verification methods.

- Lack of Standardization: The absence of a universally accepted standard for diamond grading and origin verification creates opportunities for misrepresentation.

- Complex Supply Chains: Diamond supply chains are often complex, involving multiple intermediaries, which can make it difficult to trace a diamond’s journey from mine to market.

- Fraud and Deception: Unscrupulous individuals may intentionally mix natural and lab-created diamonds or mislabel them to deceive consumers.

- Technological Limitations: While technology has improved diamond identification, it is not foolproof. There is always a risk that sophisticated methods could be used to disguise lab-created diamonds as natural diamonds.

- Cost and Resources: Implementing robust tracking and verification systems requires significant investment in technology, training, and personnel.

Environmental Impact and Sustainability: What Are The Ethical Considerations Regarding The Origin Of Natural Versus Lab-created Diamond Rings?

The environmental impact of diamond production, both natural and lab-created, is a crucial ethical consideration for consumers. Understanding the creation processes and their consequences allows for informed choices. This section explores the environmental footprint of natural diamond mining, contrasts it with lab-created diamond production, and highlights sustainability initiatives.

Environmental Footprint of Natural Diamond Mining

Natural diamond mining often leaves a significant environmental footprint, impacting ecosystems and communities. The methods used to extract diamonds can lead to habitat destruction, water pollution, and social issues.Mining processes, such as open-pit mining and alluvial mining, can cause substantial environmental damage:

- Habitat Destruction: Open-pit mining, in particular, requires clearing vast areas of land, leading to deforestation and the loss of biodiversity. Ecosystems are disrupted, and animal habitats are destroyed.

- Water Pollution: Mining operations often use large quantities of water for processing. This can lead to water pollution from chemicals used in the extraction process and the discharge of wastewater. This contamination can harm aquatic life and affect local communities’ access to clean water.

- Erosion and Soil Degradation: Mining activities can destabilize soil, leading to erosion and land degradation. This can impact agricultural productivity and increase the risk of landslides.

- Community Displacement and Social Impacts: Mining operations can displace local communities and disrupt traditional ways of life. Additionally, there can be social issues related to labor practices, working conditions, and the potential for conflict over resources.

Energy Consumption and Waste Generation: Natural vs. Lab-Grown

The energy consumption and waste generation differ significantly between natural diamond mining and lab-created diamond production. These differences are key factors in assessing their environmental impact.Natural diamond mining generally requires more energy and generates more waste compared to lab-created diamond production.

- Energy Consumption: Natural diamond mining often involves heavy machinery, transportation of materials, and processing, all of which require significant energy. Lab-created diamonds, while still energy-intensive, can be produced using renewable energy sources, reducing their carbon footprint.

- Waste Generation: Natural diamond mining generates a substantial amount of waste material, including overburden (the material removed to access the ore), tailings (the waste left after processing), and other byproducts. Lab-created diamonds produce less waste overall.

- Transportation: Natural diamonds often travel long distances from the mine to the cutting and polishing facilities, and then to the market, increasing the carbon footprint associated with transportation. Lab-created diamonds can be produced closer to consumer markets, reducing transportation emissions.

Sustainability Initiatives and Certifications

Sustainability initiatives and certifications are essential for both natural and lab-created diamonds to ensure responsible practices. These certifications help consumers make informed decisions about the environmental and social impact of their purchases.

- Natural Diamonds: The Kimberley Process Certification Scheme (KPCS) is designed to prevent conflict diamonds from entering the market. However, it does not address environmental concerns. Other certifications, such as those from the Responsible Jewellery Council (RJC), focus on responsible sourcing and environmental practices.

- Lab-Created Diamonds: The International Gemological Institute (IGI) and other organizations offer certifications for lab-created diamonds, ensuring the diamonds’ authenticity and origin. Some lab-created diamond producers are also pursuing certifications related to carbon neutrality and sustainable manufacturing processes.

Key Differences in Environmental Impact: Lab-Created Diamond Production Methods

Lab-created diamonds are produced using two primary methods: High-Pressure/High-Temperature (HPHT) and Chemical Vapor Deposition (CVD). The environmental impact varies depending on the method used.Here are the key differences:

- HPHT: This method requires high energy consumption and often involves specialized equipment. It may have a higher carbon footprint if powered by non-renewable energy sources.

- CVD: CVD generally requires less energy than HPHT. However, the environmental impact can depend on the specific CVD technology used and the energy source.

- Waste Generation: Both methods generate some waste, but the type and amount can vary. CVD often produces less solid waste compared to HPHT.

- Raw Materials: The source of carbon used in CVD can influence the environmental impact. The use of recycled carbon sources can reduce the overall footprint.

Transparency and Brand Reputation

Transparency in environmental practices significantly influences consumer perception and brand reputation. Consumers are increasingly seeking information about the environmental impact of products and prefer brands that demonstrate commitment to sustainability.Transparency builds trust and enhances brand image:

- Environmental Reporting: Brands that provide detailed information about their environmental practices, including energy consumption, waste management, and carbon emissions, are perceived more positively by consumers.

- Third-Party Certifications: Obtaining certifications from reputable organizations, such as the RJC or carbon-neutral certifications, demonstrates a commitment to responsible practices and builds consumer confidence.

- Supply Chain Traceability: Providing information about the origin of materials and the production process allows consumers to trace the environmental impact of their purchase.

- Consumer Education: Educating consumers about the environmental impact of diamond production empowers them to make informed choices and supports brands that prioritize sustainability.

Social and Labor Issues: Ethical Sourcing and Fair Practices

The ethical landscape of diamond sourcing extends far beyond environmental concerns, deeply impacting the lives of individuals involved in the mining and manufacturing processes. Ensuring fair labor practices and worker rights is crucial for responsible diamond consumption. This section delves into the social and labor issues surrounding both natural and lab-created diamonds, providing a comprehensive comparison of their ethical implications.

Labor Practices in Natural Diamond Mining

The extraction of natural diamonds often occurs in regions with significant socio-economic challenges, making fair labor practices a paramount concern. These practices encompass fair wages, safe working conditions, and the protection of worker rights.The mining of natural diamonds can involve significant ethical dilemmas, including:

- Fair Wages and Compensation: Many diamond miners, particularly in developing countries, receive meager wages that barely cover basic living expenses. This often leads to cycles of poverty and exploitation. For example, a 2018 report by Human Rights Watch highlighted the low wages and poor working conditions in diamond mines in the Central African Republic.

- Working Conditions and Safety: Diamond mining can be dangerous, with risks including mine collapses, exposure to hazardous materials, and inadequate safety equipment. Accidents are frequent, and access to healthcare is often limited.

- Child Labor: Despite efforts to eradicate it, child labor persists in some diamond mining operations. Children are often employed in hazardous tasks, jeopardizing their health and education. The International Labour Organization (ILO) has documented instances of child labor in diamond mining, particularly in artisanal and small-scale mining operations.

- Freedom of Association: Workers may face restrictions on their ability to form unions or advocate for better working conditions. This lack of agency leaves them vulnerable to exploitation.

Conflict Diamonds and the Kimberley Process

A significant ethical concern in natural diamond sourcing is the prevalence of conflict diamonds, also known as “blood diamonds.” These are diamonds mined in war zones and sold to finance armed conflicts against legitimate governments.The Kimberley Process Certification Scheme (KPCS) was established in 2003 to prevent conflict diamonds from entering the legitimate diamond market. It aims to ensure that diamond exports are conflict-free.

However, the effectiveness of the Kimberley Process is a subject of ongoing debate:

- Strengths of the Kimberley Process: The KPCS has significantly reduced the trade in conflict diamonds, providing a framework for governments to certify diamond exports. It has helped to stabilize regions affected by conflict and promote responsible mining practices.

- Weaknesses of the Kimberley Process: The KPCS has been criticized for its narrow definition of conflict diamonds, which focuses primarily on rebel groups and excludes human rights abuses and labor exploitation. It also lacks effective enforcement mechanisms and has faced challenges in verifying the origin of diamonds. The process has also been accused of being too lenient, allowing diamonds from countries with problematic human rights records to be certified.

- Gaps in Coverage: The KPCS does not adequately address issues such as fair wages, safe working conditions, and environmental impact. These concerns, while crucial for ethical sourcing, fall outside the scope of the KPCS.

Social and Labor Considerations in Lab-Grown Diamond Creation

Lab-grown diamonds, while offering an alternative to the environmental and conflict concerns associated with natural diamonds, also present their own set of social and labor considerations. These considerations primarily revolve around factory conditions and worker rights.

- Factory Conditions: The conditions in which lab-grown diamonds are manufactured can vary widely. Some factories prioritize worker safety and well-being, while others may cut corners to reduce costs. Issues to consider include:

- Safety Protocols: The presence and enforcement of safety protocols to protect workers from potential hazards associated with high-pressure, high-temperature processes.

- Ventilation and Air Quality: Adequate ventilation to mitigate exposure to potentially harmful gases and dust.

- Cleanliness and Hygiene: The maintenance of clean and hygienic working environments.

- Worker Rights: Worker rights in lab-grown diamond factories are paramount, and ensuring these rights include:

- Fair Wages: The provision of wages that meet or exceed local living standards.

- Working Hours: Adherence to reasonable working hours and the provision of breaks.

- Freedom of Association: Allowing workers to form unions and advocate for their rights.

- Non-Discrimination: Ensuring a workplace free from discrimination based on gender, race, religion, or other protected characteristics.

Arguments For and Against the Impact of Diamond Sourcing on Social Issues

Arguments For:

- Natural Diamonds: Support economic development in mining communities, providing jobs and income. The Kimberley Process helps to curb conflict and promote stability.

- Lab-Grown Diamonds: Offer potentially better working conditions and fairer wages in manufacturing facilities. Can reduce the demand for natural diamonds, lessening the impact on mining communities.

Arguments Against:

- Natural Diamonds: Often involve exploitative labor practices, including low wages, dangerous working conditions, and child labor. The Kimberley Process has limitations and struggles to address all ethical concerns.

- Lab-Grown Diamonds: Factory conditions may be poor, with potential for exploitation. Manufacturing can relocate to countries with lower labor standards, creating risks of worker abuse.

Ideal Ethical Sourcing Practices: A Visual Illustration, What are the ethical considerations regarding the origin of natural versus lab-created diamond rings?

The ideal ethical sourcing practices for both natural and lab-created diamonds encompass a range of measures aimed at ensuring fair labor practices and worker rights. The illustration below describes these practices:

Natural Diamond Ethical Sourcing Illustration:

The illustration depicts a diamond mine, with various elements symbolizing ethical sourcing practices.

Miners

The miners are depicted wearing appropriate safety gear (helmets, gloves, boots) and working in a well-lit and ventilated environment. They are diverse in terms of gender and ethnicity, signifying fair employment practices.

Fair Wages Sign

A sign indicates the payment of fair wages, exceeding the local living wage. The sign includes a clear statement about fair compensation.

Union Representation

A group of miners are meeting with a union representative, indicating freedom of association and collective bargaining rights.

Community Development Projects

Depicted nearby are community development projects, such as schools and healthcare facilities, supported by the mining operation. This demonstrates a commitment to community well-being.

Kimberley Process Certification

The diamond shipment is accompanied by a Kimberley Process certificate, ensuring the diamonds are conflict-free.

Auditing

A third-party auditor is present, overseeing the mining operations to ensure compliance with ethical standards.

Lab-Grown Diamond Ethical Sourcing Illustration:

The illustration presents a modern, well-equipped factory environment.

Workers

The workers are shown operating advanced equipment in a clean and organized workspace. They are wearing appropriate safety gear.

Fair Wages and Benefits

A chart illustrates that workers receive fair wages, healthcare, and other benefits.

Safety Protocols

Clearly visible safety protocols, including emergency exits and fire safety equipment, are in place.

Sustainability Practices

The factory is depicted as utilizing renewable energy sources and implementing waste reduction measures, demonstrating a commitment to environmental sustainability.

Worker Representation

A worker representative is seen participating in a meeting with management, ensuring worker voices are heard.

Transparency

The factory is open to audits and transparent in its operations, ensuring accountability and adherence to ethical standards.